new mexico gross receipts tax return

Total Gross Receipts Tax. Sell property in New Mexico.

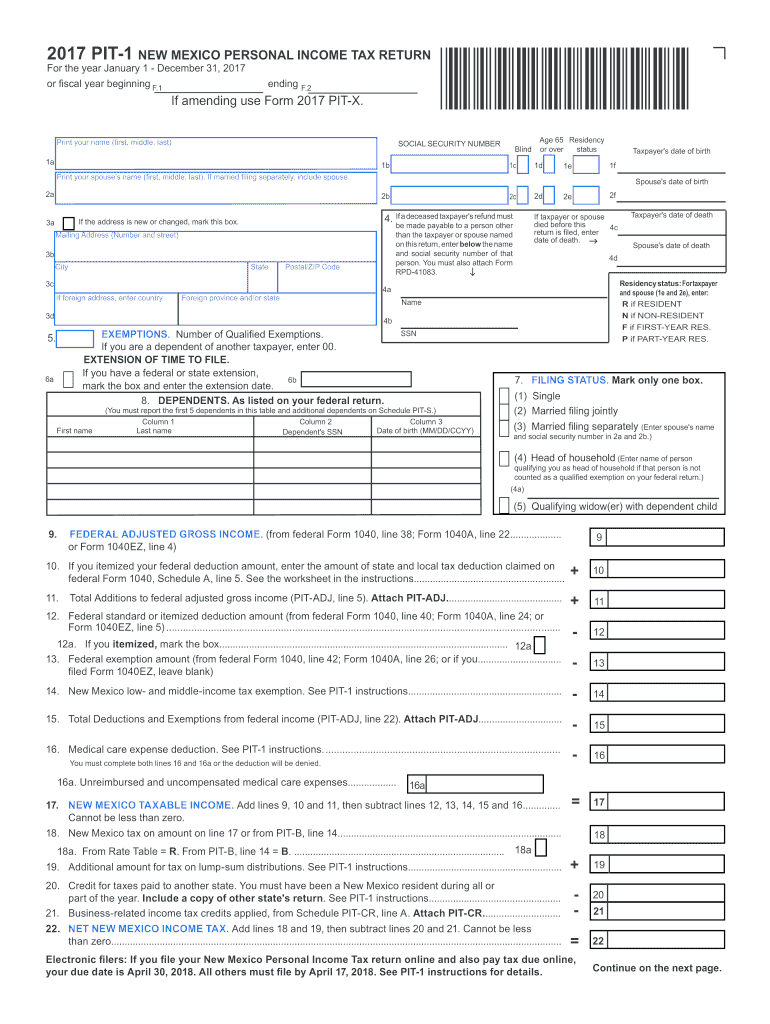

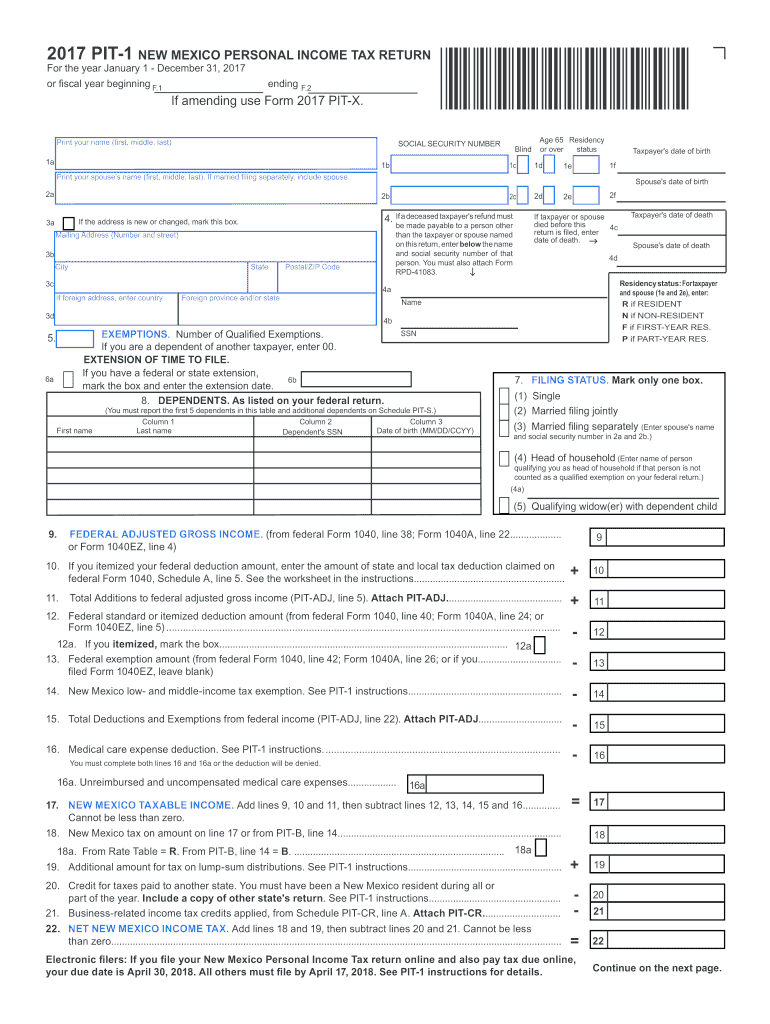

2017 Form Nm Trd Pit 1 Fill Online Printable Fillable Blank Pdffiller

019 2020 2021 8 hours ago revenue source.

. If you have no business location or resident salesperson but are liable for gross receipts tax for instance because you lease property used in New Mexico or perform a non-construction service in New Mexico you are liable for tax at the rate for out-of-state businesses the state gross receipts tax rate of 5125. Effective July 1 2021 the CRS number will be referred to as the New Mexico Business Tax Identification Number NMBTIN. The Taxation and Revenue Department of New Mexico implemented two changes effective July 1 2021.

As for payment E-pay is the quick and green way to. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. As for the gross receipts tax cut it would lower the states rate by 025 percentage points from 5125 to 4875 in a move projected to generate roughly 191 million in.

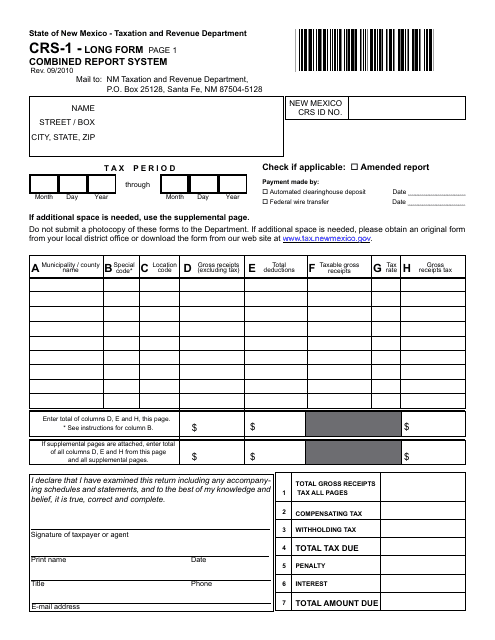

GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return. The tax is imposed on the gross receipts of persons who. We urge you to give it a try.

Child Tax Credit Dates. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports. Combined Fuel Tax Distribution.

If Schedule A pages are attached enter total of columns D and I. AEnter the total amount of gross receipts tax due here. TOTAL TAX DUE WITHHOLDING TAX INTEREST TOTAL AMOUNT DUE COMPENSATING TAX I declare that I have examined this return including any accompany - ing schedules and statements and to the best of my knowledge and belief it is true correct and complete.

Gross Receipts Tax Compensating Tax and Governmental Gross Receipts Tax IMPOSITION AND DENOMINATION 7-9-4. Ad Download Or Email ACD-31096 More Fillable Forms Register and Subscribe Now. The Gross Receipts tax rate now is calculated based on where the goods or.

The legislation would amend a statute that excludes receipts from launching operating or recovering space vehicles or payloads in New Mexico from gross receipts taxes. Many of the documents have been updated to reflect this change. Expand the folders below to find the documents you are looking for.

Fiscal Year RP-80 Reports. How to use this page. The filing process forces you to detail your total sales in the state the amount of gross receipts tax collected and the location of each sale.

They offer faster service than transactions via mail or in person. If you are engaged in business in New Mexico you must file a New Mexico tax return and pay gross receipts tax for the privilege of doing business in New Mexico. Imposition and rate of tax.

The tax imposed by. AN OVERVIEW July 1 2013 - June 30 2014 Taxpayers should be aware that subsequent legislation regulations court decisions revenue rulings notices and announcements. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the.

Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things. Gross Receipts Tax 10M cabqgov. Breakfast Restaurants In Evanston Wyoming.

The tax is imposed on the gross receipts of businesses or people who sell property perform services lease or license property or license a franchise in New Mexico. This is the same 11-digit tax identification number. Gross Receipts by Geographic Area and NAICS code.

Property includes real property tangible personal property including electricity and manufactured homes licenses other than. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. The same goes for those who sell research and development services performed outside New Mexico when the resulting product is initially used here.

Gross Receipts by Geographic Area and NAICS Code. New Mexico Taxation and Revenue Department GOVERNMENTAL GROSS RECEIPTS TAX RETURN This report can be filed online at httpstapstatenmus I declare that I have examined this return including any accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete. Tax InformationPolicy Office PO.

Certain taxpayers are required to file the Form TRD-41413 electronically. Gross Receipts by Geographic Area and NAICS Code. Jul 8 2020 Jobs the Economy Other Affected Services Tax and Rev.

Gross Cabqgov Show details. SANTA FE New Mexico personal and corporate income tax returns for 2019 must be filed by July 15 to avoid penalties under a law enacted during the recent special legislative session. New Mexico Gross Receipts Tax Changes.

TOTAL GROSS RECEIPTS 1 TAX ALL PAGES 2 3 5 6 4 7 Enter total of columns D E and H this page. BEnter the total amount of gross re- ceipts tax from all Schedule A pages. Filing online is fast efficient easy and user friendly.

New Mexico Sales Tax Collection and Reporting Update. The Leading Online Publisher of National and State-specific Legal Documents. The tax imposed by this section shall be referred to.

For the privilege of engaging in business an excise tax equal to five and one-eighth percent of gross receipts is imposed on any person engaging in business in New Mexico. Michelle Lujan Grisham recently signed into law a bill that waives penalties and interest on late. Enter the total amount of gross receipts excluding tax here.

Box 630 Santa Fe New Mexico 87504-0630 GROSS RECEIPTS COMPENSATING TAXES. Filing a New Mexico gross receipts tax return is a two-step process comprised of submitting the required sales data filing a return and remitting the collected tax dollars if any to the New Mexico TRD. Electronic transactions are safe and secure.

Chinese Restaurants In Elizabeth City Nc. For purposes of this section receipts are not subject to the gross receipts tax if the person responsible for the gross receipts tax on those receipts lacked nexus in New Mexico or the receipts were exempt or allowed to be deducted pursuant to the Gross Receipts and Compensating Tax Act. Each Form TRD-41413 is due on or before the 25th of the month following the end of the tax period being reported.

New Mexico has a statewide tax rate of 50 and shares with each municipality 1225 of the statewide gross receipts paid by taxpayers doing business within the City. Japanese Beetle Life Cycle Illinois. Denomination as gross receipts tax.

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Tax Return Fake Tax Return Income Tax Return Money Template

Understanding The 1065 Form Scalefactor

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

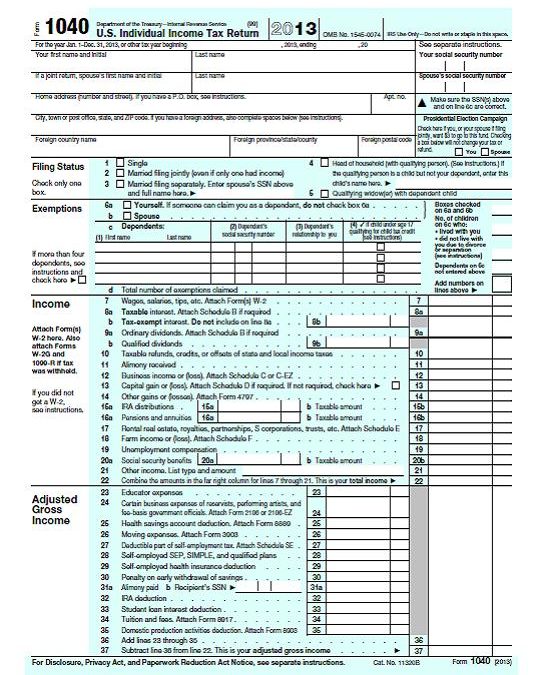

2013 Federal Tax Refunds Waiting For Non Filers

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats